how to calculate a stock's price

Stock Price Dividends Paid Div Expected Price P1 1 Expected Return R Proving this calculation with our example information above we have. We can rearrange the equation to give us a companys stock price giving us this formula to work with.

What S A Typical Day For Someone In M A Cost Of Capital Investing Investment Companies

Stock value Dividend per share Required Rate of Return Dividend Growth Rate Rate of Return Dividend Payment Stock Price Dividend Growth Rate.

. Just follow the 5 easy steps below. Ad MarketSmith helps you invest in the right stocks at the right time-Take a trial. Click the Calculate Stock Price button.

Here look for the trailing PE as of December 31st 2019. 19 is 16 times. Ad When Traders Tell Us How to Make thinkorswim Even Better We Listen.

All Straight from Industry Pros. The formula to calculate the target price is. Enter the required rate of return.

For an investor price target reflects the price at which he will be willing to buy or sell the stock at a particular period of time or mark an exit from their current position. For instance Ill say with complete confidence that Stock A with a PE of 15 and Debt to Equity below 05 has far better upside than Stock B with negative earnings and a Debt. Cost of Preferred Stock Preferred Stock Dividend D Preferred Stock Price P.

If it were trading at its historical PE ratio of 18 the current stock price should be 18 times 4. ADividing the current PE ratio is 47. Heres an easy formula for calculating the value of preferred stock.

The process of determining the maximum price you should pay for various stocks. How to Calculate share value Example. In this case the adjusted closing price calculation will be 20 1 21.

Annual Dividends per share. Par value of one share of preferred. Announces a 21 stock.

Enter the number of shares purchased Enter the purchase price per share the selling price per share Enter the commission fees for buying and selling. This price is a perceived value of the traders which is affected by many. Stock price price-to-earnings ratio earnings per share.

P D 1 r g where. The price of one share of a company is determined by the traders in the marketplace. This will give you a price of 667 rounded to the nearest penny.

Stock Price 300. P Current Stock Price g Constant growth rate in perpetuity expected for the dividends r Constant cost of equity capital for that company or rate of. Calculating expected price only works for certain types of stocks For newly established companies with rapid growth and unpredictable earnings and dividends future.

Fields Terms and Definitions. Last 12-months earnings per share. How to Calculate a Stock Price.

Price Estimated EPS Trailing PE where Price is the variable.

Present Value Of A Growing Annuity Calculator Double Entry Bookkeeping Annuity Calculator Calculator Annuity

Common Stock Formula Calculator Examples With Excel Template

Present Value Of Stock With Constant Growth Formula With Calculator

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Excel Finance Class 65 Calculate Stock Price At Time T Using Dividend Growth Model Youtube

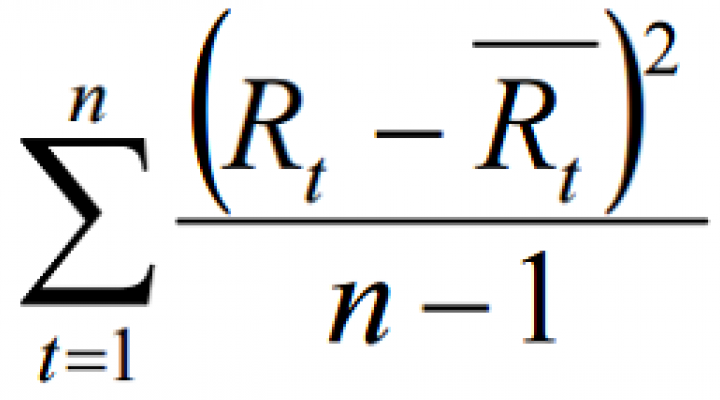

How To Calculate The Historical Variance Of Stock Returns Nasdaq

How To Calculate The Historical Variance Of Stock Returns The Motley Fool

How To Calculate Future Expected Stock Price The Motley Fool

How To Calculate The Weights Of Stocks The Motley Fool

How To Calculate The Issue Price Per Share Of Stock The Motley Fool

How Is Market Price Per Share Calculated Quora

Is There A Mathematical Formula To Calculate A Stock Price Quora

Price Volatility Definition Calculation Video Lesson Transcript Study Com

2019 Trading Days Calendar Swingtradesystems Com Stock Market Trading Us Stock Market

How To Calculate Future Expected Stock Price The Motley Fool

This Free Online Stock Investment Calculator Will Calculate The Expected Rate Of Return Given A Stock S Current Dividend Investing Online Mortgage Online Stock

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)